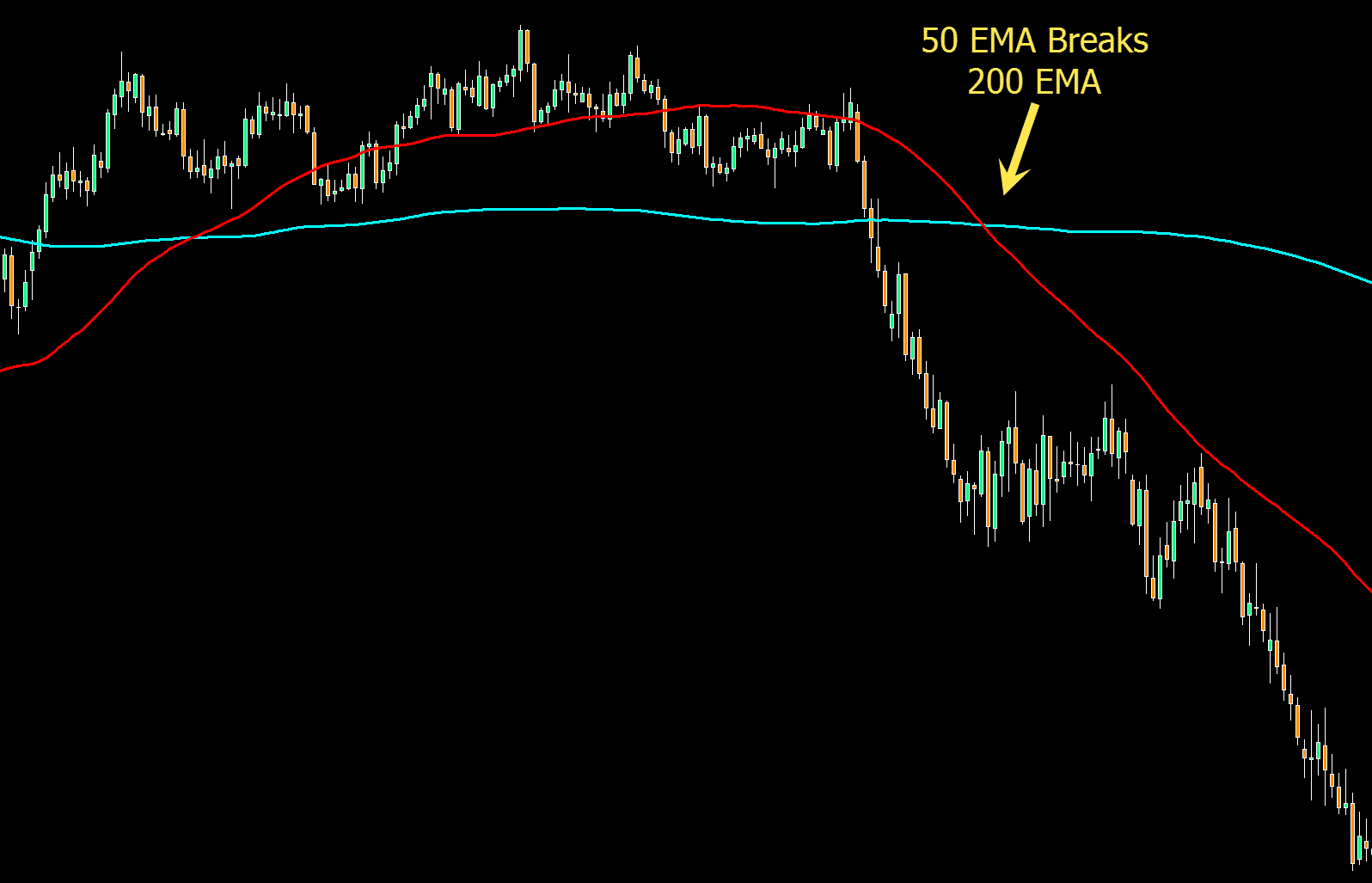

The example shows a bullish flag pattern within the uptrend confirmed by 50 EMA trading above 200 EMA and later on you can see the inverse head and shoulders pattern which is bullish and comes within the uptrend. In the above buy set up example, we can see how chart patterns or price action can also be combined into the 50/200 day moving average set up. It signals that the trend is shifting.ĥ0 200 day Moving Average Crossover Strategy – Long Trading Examples Golden Cross: Golden cross is the opposite of death cross and refers to when the 50 day moving average cuts the 200 day moving average from below. The trading system can also be used by combining other oscillators or indicators. When using the 50 200 day Moving Average Crossover Strategy, there are two commonly used terms:ĭeath Cross: Death cross is commonly used term which refers to when the 50 day moving average cuts the 200 day moving average from above. For example some traders prefer to use the 50 and 200 day moving average as a trend following set up, but this means having to hold the trades for long periods of time, while some can use the 50 – 200 day moving average and simply trade the markets for a few pips.

The 50 and 200 day moving average is an open trading system and traders can apply their own rules. It is up to the trader on what type of moving average they want to use as there is no big difference in terms of a trading edge between the two types of moving averages. To use the moving averages, some traders prefer to use the exponential moving average or EMA, while some prefer to use the simple moving average or SMA. The 50 and 200 day moving averages are often used to determine the trends and whether the markets are bullish or bearish. The Profit Booster Report Download Link This trading system is applied only to the daily charts therefore intraday traders or scalpers will find it inconvenient as it requires a lot of time (weeks or months) to get a good signal. If you watch any financial news channels, chances are that when the professional traders speak, they often refer to the 50 day and 200 day moving averages, which only goes to show how important these two moving averages are. Trading with the 50 day and 200 day moving average is quite simple, buying and selling on the moving average crossover.

The 50 200 day Moving Average Crossover Strategy is one of the most commonly used trading methods applied by both professional as well as part time traders.

0 kommentar(er)

0 kommentar(er)